THE CENTER OF GRAVITY FOR ENTREPRENEURS IN TEXAS

NTEN & NetSquared Nonprofit Tech Club Austin: Nonprofit Taxes – From Preparing Form 990s to Submitting Them Electronically

Even though they are tax-exempt, most nonprofit organizations are required to file annual tax returns (via a Form 990) with the IRS. James Bradley, CPA, Tax Manager for Millan & Co. P.C.: Consultants and Certified Accountants, will share nonprofit best practices for filing with the IRS. You will learn about online submissions, about Form 990 sections on disclosure and governance, about electronic IRS tax audits of that form, and more. Come with your questions – Jim will have answers!

About Our Speaker

James Bradley is the Tax Manager for Millan & Company of Austin. He received his Masters in Business Taxation from the University of Southern California and has over twenty years experience as a certified public accountant. He has spent years providing complex accounting and tax advisory services to public charities, social welfare organizations, trade associations, and political organizations and he has been with Millan & Co., P.C. since 2007.

Nonprofit Tech Club Austin #NPTechClubATX is part of a network of tech clubs across the nation and the world. NTEN: Nonprofit Technology Network and NetSquared (a division of TechSoup), are co-sponsors. Meetings are free and open to all. We are inclusive and celebrate multiple approaches, backgrounds and points of view. Our aim is to help nonprofits find cost-effective tech solutions and techniques to make their work easier, more secure and efficient.

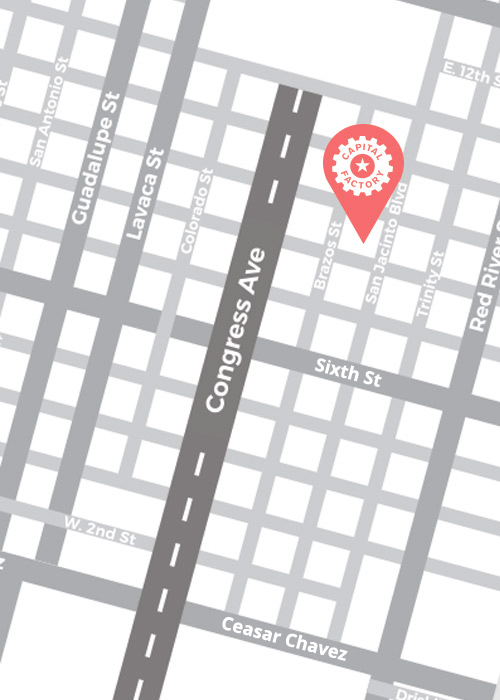

We would like to thank Capital Factory for being our primary venue host during 2020. Our tech club programs will also appear on the Capital Factory event calendar. We are pleased Trianon Coffee will continue as a #NPTechClubATX sponsor during 2020. Hearty thanks to both!

Sincerely,

#NPTechClubATX Volunteer Team

By Appointment Only

Our doors are open! Reach out to Members@CapitalFactory.com to book your private, in-person membership tour.